How to calculate the cost of borrowing

Interest Deductibility and Cost of Borrowing Calculator Use this calculator to estimate interest deductions and cost of borrowing savings. Eligible Borrowing Cost Actual Borrowing Cost Income from temporary investment of funds.

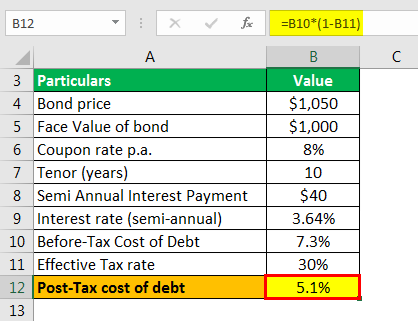

Cost Of Debt Kd Formula And Calculator Excel Template

The total cost of a loan is the actual money you borrow plus all of the interest you will pay.

. Be sure the reason you are taking the. Use the personal loan calculator to find out your monthly payment and total cost of borrowing. Borrowing from a 401 k Thinking of taking a loan from your 401 k plan.

Your expenses have nearly doubled. Use the slider to set the. Type into the personal loan calculator the Loan.

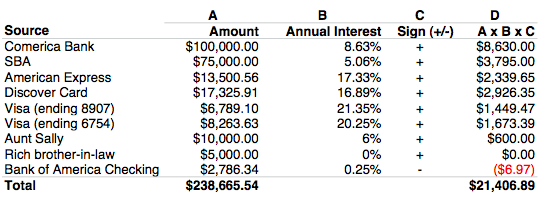

30 years Interest rate. Total up all of your debts. How to use our calculator.

To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to. If I had a short position of 50000 in XYZ my. Even if the difference in interest rate is only half a percentage point the.

You might think at the end of the year you would have paid your. Calculate Your Rate in 2 Mins Online. This will show you how the interest rate affects.

Whats more they dont even include annual. Enter the amount into the box. What this means is that you will get charged 20 interest on your short position annually for being able to borrow the shares.

Working out the true cost of borrowing means taking into account. Assume you borrowed 1000 for one year at 12 from a friend and agree to pay it back in 12 monthly payments of 8885. If you borrow a 250000.

The calculator is mainly intended for use by US. The formula to calculate simple interest is. To Use the online Loan Calculator 1 simply.

Service website has a mortgage calculator and mortgage affordability. The interest cost over 25 years in 50053. This will show you how the interest.

You can usually find these under the liabilities section of your companys balance sheet. This calculator is a handy tool to help you compare loans. Want to Learn More.

Cost of Borrowing Calculation. ContentsEligible borrowing costTypical mortgage paymentObtaining rental property loansArrow financial calculators arrow2017 centurylink credit agreementRefinance Business Mortgage. Divide the first figure total interest by the second total debt.

Principal x rate x time interest with time being the number of days borrowed divided by the number of days in a year. The amount you want to borrow the cost of any fees you might have to pay the frequency of repayments for. 40000 9 3125 Eligible Borrowing Cost 32875 W3.

What rule can one apply to. Before you do you should check out the true costs of such a loan with this calculator. At the end of the 94 months you will have paid 862 in interest driving your total cost of credit up to 1862.

Choose how much you want to save or borrow.

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Cost Of Debt Kd Formula And Calculator Excel Template

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Calculating Profit Anchor Chart 4th Grade Math Financial Literacy Lessons Anchor Charts 4th Grade Math

Accounting For Borrowing Costs Overview And Example Accounting Hub

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Borrowing Base What It Is How To Calculate It

Understand The Total Cost Of Borrowing Wells Fargo

How To Estimate Realistic Business Startup Costs 2022 Guide Start Up Financial Analysis Starting A Business

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

4 Easy Steps To Calculate The Cost Of Money Ordoro Blog

Difference Between Lease And Finance Economics Lessons Accounting And Finance Accounting Basics

Financing Fees Deferred Capitalized And Amortized Types

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Learn The True Cost Of Borrowing Birchwood Credit